What Is The Fica And Medicare Rate For 2025. Fica taxes are divided into two parts: The fica tax rate, which is the combined social security rate of 6.2 percent and the medicare rate of 1.45 percent, remains 7.65 percent for 2025 (or 8.55.

Learn About FICA, Social Security, and Medicare Taxes, 6.2% goes toward social security tax and 1.45% goes toward medicare tax, which helps fund benefits for children, retirees and the disabled. In 2025, the medicare tax rate is 2.9%, with half (1.45%) paid by the employee and the other half (1.45%) paid by the employer.

Overview of FICA Tax Medicare & Social Security, Medicare tax = gross income × medicare tax rate; Fica is a 15.3% payroll tax that funds social security and medicare.

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

What Is Medicare And Social Security Tax For 2017, For 2025, an employer must withhold: 6.2% on earnings up to the taxable maximum :

Family Finance Favs Don't Leave Teens Wondering "What The FICA?", The fica tax rate is based on current laws and regulations, which determine the percentages for social security and medicare taxes. The employer fica rate is 7.65% in 2025.

Understanding the important role of FICA in Social Security Disability, Social security tax and medicare tax. 6.2% goes toward social security tax and 1.45% goes toward medicare tax, which helps fund benefits for children, retirees and the disabled.

Social Security Wage Base 2025 [Updated for 2025] UZIO Inc, Employees and employers split the total cost. In 2025, the medicare tax rate is 2.9%, with half (1.45%) paid by the employee and the other half (1.45%) paid by the employer.

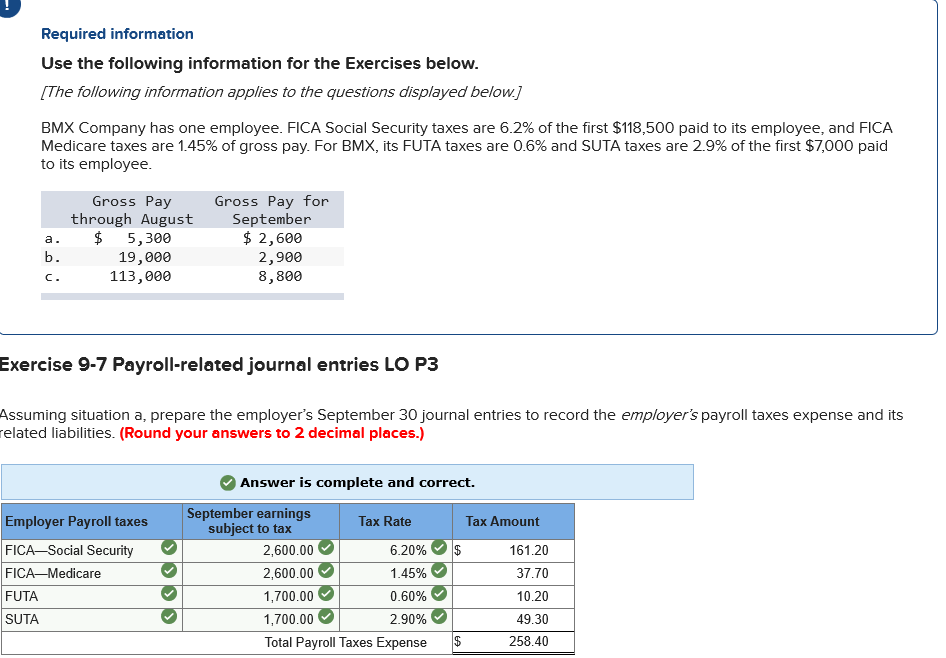

Solved Required information Use the following information, Social security tax must be withheld at 6.2% until employees’ wages reach this limit. Social security tax rate :

![Social Security Wage Base 2025 [Updated for 2025] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023.png)

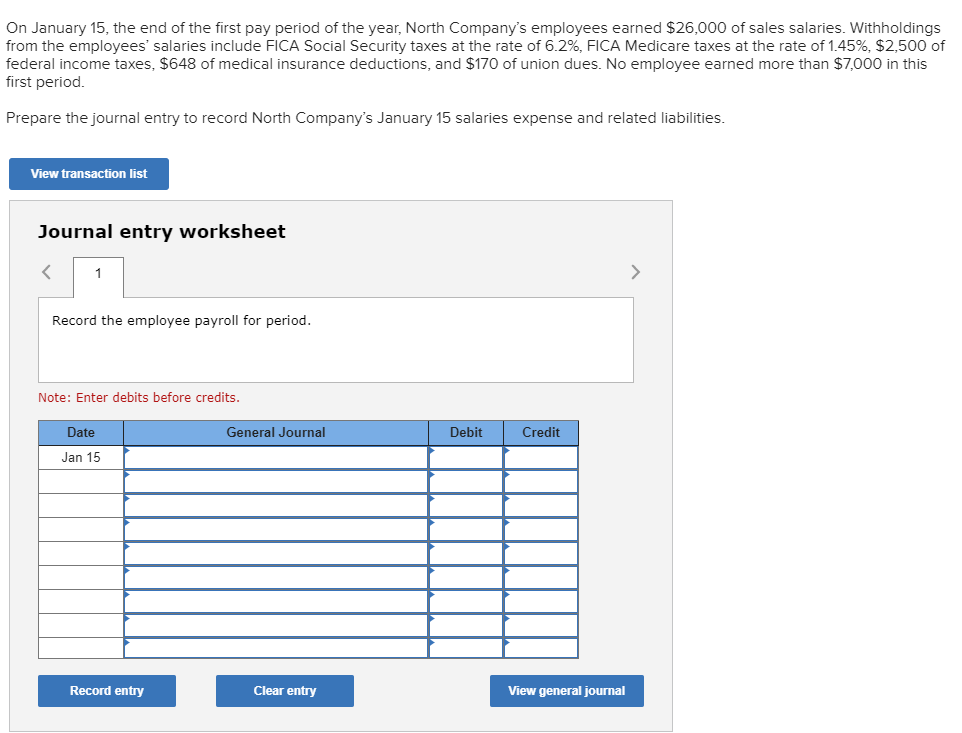

Solved On January 15, the end of the first pay period of the, As of now, the fica tax rate. For both of them, the current social security and medicare tax rates are 6.2% and 1.45%, respectively.

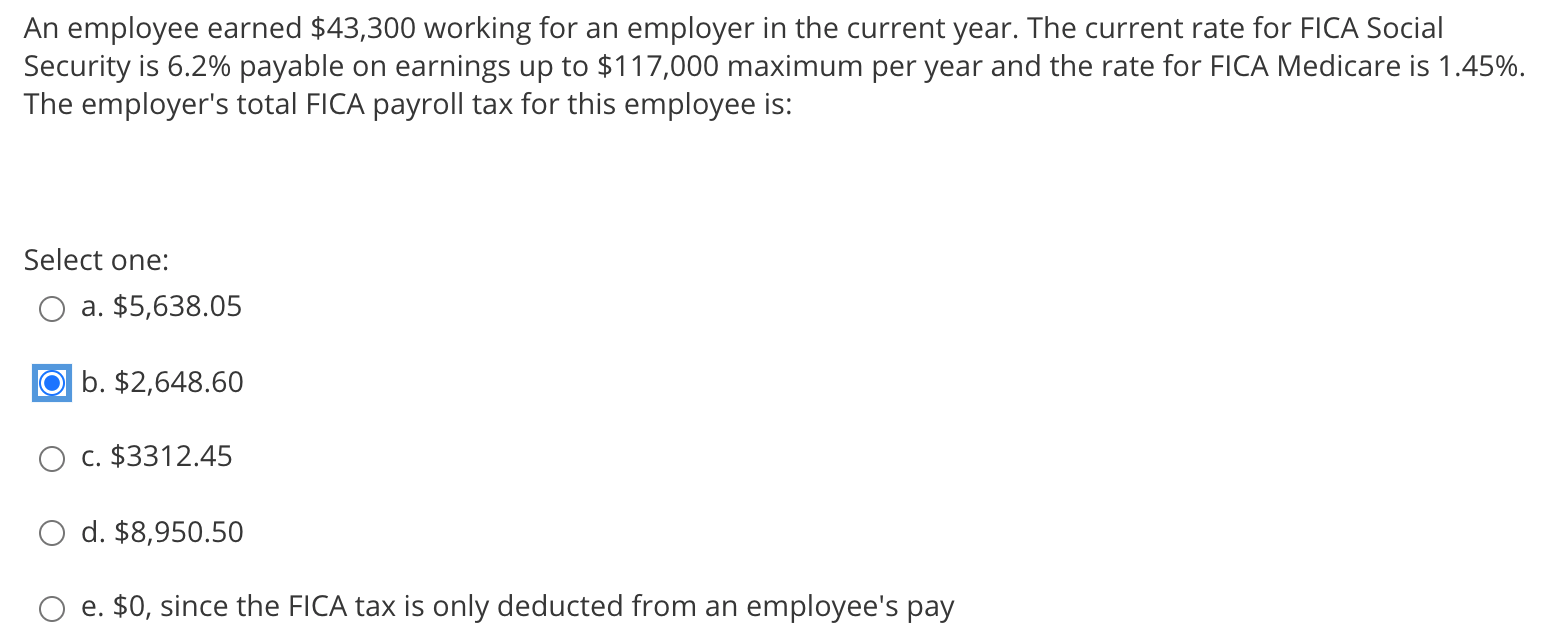

Solved An employee earned 43,300 working for an employer in, For 2025, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare). Social security and medicare taxes are based on gross earnings of each employee each year.

FICA and Medicare Tax Rates 6.2 1.45 2.35 · FICA and Medicare Tax, Overall, the fica tax rate is 7.65%: The social security tax rate is 6.2% of wages for 2025, and the medicare tax rate is.

For 2025, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare).

In 2025, the medicare tax rate is 2.9%, with half (1.45%) paid by the employee and the other half (1.45%) paid by the employer.